Sales commission structures are essential for motivating high-performing sales teams and retaining top talent by rewarding them fairly and transparently.

- Prioritize fair compensation to keep your best salespeople engaged and reduce turnover risk.

- Align commission plans with business goals to drive consistent revenue growth.

- Choose the right mix of base salary and commission to balance stability and motivation.

- Automate commission tracking and payouts for accuracy and transparency.

Here’s a secret. Companies are more worried about losing amazing sales folks than meeting their revenue goals. With high-performing sales teams, it’s easier to meet your revenue goals. And, to make sure salespeople stay, you’ve to reward them fairly. But, how do you do that? This is where you need a sales commission structure that keeps them motivated.

If you’re new to incentive compensation, then you’ve come to the right place to learn about the sales commission structures, their different types, and when to use them. Read on.

First up, the basics.

What is a Sales Commission Structure?

Unlike engineering roles, salespeople’s compensation structure don’t necessarily have a 100% fixed salary paid out to them every month. They have something called OTE (On-target-earnings). On-target earnings are a mix of fixed salary and variable incentive pay with 50 to 75% being the fixed part.

Sales commissions structure defines how sales reps get paid for their variable pay component. You have a target and the % of commissions paid out is proportional to the target achieved.

Why are Sales Commission Structures Important?

Sales commissions are one of the best ways to ensure skin in the game for salespeople. Sales is not a qualitative job. Their impact on the company can be reasonably quantified and measured.

Commissions structure helps you establish just that and reward reps based on their impact. In this case, it is the business they close for the company.

Implementing a sales commission structure can have several benefits for a business, including:

- Motivating sales representatives: Sales commission structures provide an incentive for sales reps to work harder and sell more, as they have a direct financial incentive to do so. This can result in increased productivity and better sales results.

- Attracting and retaining top sales talent: A well-designed sales commission structure can help businesses attract and retain top sales talent by offering a competitive compensation package that rewards high performers.

- Aligning sales goals with business objectives: A commission structure can be tailored to align with specific business goals and objectives. For example, a business may choose to incentivize sales reps to focus on selling high-margin products or services.

- Increasing revenue and profitability: By motivating sales reps to sell more, a commission structure can lead to increased revenue and profitability for the business.

- Improving sales forecasting and planning: A commission structure can provide valuable insights into sales performance and help businesses forecast and plan for future sales growth.

- Encouraging teamwork and collaboration: Commission structures can be designed to reward teamwork and collaboration among sales reps, fostering a supportive and collaborative sales culture.

Overall, a well-designed sales commission structure can be a powerful tool for businesses looking to motivate sales reps, drive revenue growth, and achieve their business objectives.

Now that we know what the sales commission structure is and why it is important, onto its types.

Types of Sales Commission Structures

Figuring out the right sales commission structure to deploy for your sales organization can be a mammoth and convoluted task, given that it hinges on a lot of factors. To help you make an informed decision, we’ve curated below the typical sales commission structures that are widely used.

Base Salary Plus Commission Plan

Base Salary Plus Commission Plan is one of the most common ways of configuring sales commissions structures. It includes a base component or base pay that is fixed and paid out every month. There is also a commission component paid out quarterly or monthly. This depends on how the targets are set for the sales role. For example, 60% is fixed pay and 40% is the commissions component.

For example,

$200K OTE = $120K Fixed + $80K Commissions

How we calculate the $80K commissions is a different endeavor altogether. Head to our compensation guide to know how. In most scenarios, it is a percentage of the product value sold.

If a rep has an 8% flat commissions rate for every sale, then to attain $80k in commissions, a rep has to make $1M worth of sales.

When to use it?

Since it is the most common way of compensation, it should be your go-to plan for sales compensation unless you have some unique insight that might suggest otherwise.

Pros: Sure shot and battle-tested standard plan that ensures reps get a fixed salary every month.

Cons: There are some specific scenarios where this may not work out which we will address below.

Straight Commission or Commission Only Plan

Straight Commission or Commission Only Plan is quite an aggressive commission plan. The commissions are the only form of payout for sales reps. It is a very high-risk plan to undertake and hence, rarely used in big companies.

When to use it?

It is reserved for companies whose sales are purely transactional. A very commercialized product that is well-known or something like an insurance product might have sales teams that fall into this kind of model.

Pros: It reduces upfront costs for the company. The risk taken by the company is close to nil as they only pay the reps if they bring in revenue.

Cons: Sales will be mercenaries and might leave anytime without any commitment to your firm as they don’t get a fixed salary.

Gross Margin Commission Plan

A slight variation on the revenue commission model is the gross margin commission, which takes into account the expenses associated with the products you sell.

Rather than earning a percentage of the revenue, sales reps earn a percentage of the profit.

Total Sale Price - Cost = Gross Margin.

Gross Margin x Commission Percentage = Total Commission.

Pros: This kind of sales commission structure is reserved for very old-school well established traditional businesses or service businesses. There might be variable costs involved and hence difficult to pay reps purely based on sales.

Cons: This model doesn’t incentivize growth. Reps have a hard time selling a product. It gets more difficult with a gross margin to keep in check.

Tiered Commission Plans

In a tiered commission structure plan, you are rewarded for how good your target attainment is instead of the revenue impacted.

So, if you attain less than 100%, you get paid your incentive pay at 1x and above 100%, the additional attainment is paid out at 2x, and so on.

When to use it?

This is reserved for companies that want to retain parity among reps regardless of their revenue impact. This is also used when reps sell a product in one currency but get paid out in another currency

Pros: Tiers create a sense of fairness among reps ensuring they get paid on their target rather than revenue. Reps can have different quotas and the ones with lesser quotas will be benefited from such a model.

Cons: It somewhat restricts your earning potential to an extent. A commission rate model incentivizes you for every $ regardless of the target attainment and gives much more lucrative rewards once you are able to hit the home runs.

Draw against Commission

In sales, draws can mean one of two things: an advance against commissions or a guarantee paid out during times of sales uncertainty.

Draws against commission dictate a reps’ personal cash flow. There are 2 types of draws,

- Recoverable draws

- Non-Recoverable draws

When to use it?

Recoverable draws are paid out as an advance against commissions and are used in the following ways:

- A seasonal business where reps may run dry of deals in a quarter

- Incentive heavy compensation plans where reps are heavily dependent on closures

- Longer sales cycles where deals that take a year and above to close

Non-recoverable draw payments made to the sales rep, as the name suggests, can’t be completely recovered.

They are used in cases given below:

- New hires get a guaranteed draw during their initial days to ease them in

- Guaranteed payouts during unforeseen circumstances like storms or COVID

Pros: They are paid as a goodwill gesture by the company during certain periods of uncertainty and to ensure that reps are motivated.

Cons: When it comes to recoverable draws, if not enforced properly, reps might get paid unfairly and might leave the firm mid-way, if they know a clawback is coming their way.

Base Rate Only

This is a model where sales professionals don’t have commission plans. It is a modern way that has been adopted by very specific firms to show that commissions cause unnecessary pressure and sales reps can be trusted to bring in business even without them.

Atlassian is one of the few widely known firms with this model. There isn’t enough data to deep-dive into this structure.

Territory Volume Commission Plan

This is a model where reps are compensated based on the collective team performance rather than their individual performance. It is widely used by companies with a retail sales model where multiple reps end up assisting a sale.

Sales Commissions = (Store/Territory Total Sales * Commissions %)/ # of Reps

When to use it?

Whenever you can’t directly attribute new business closed to a single rep, this model is preferred to ensure collaboration and teamwork.

Pros: It helps keep all sales reps aligned towards a common goal and common reward.

Cons: If a sales rep is doing a very good job, this model might not give them a lot of room to make additional sales incentives. It caps them to the average of the group.

Now, you’ve picked out the type of commission structure suitable for your business. What then? You need to structure it for your sales teams.

Residual Commission Plan

A residual commission plan is a compensation model that provides sales reps with ongoing commissions for the sales they generate over an extended period. This type of plan is commonly used in industries where customers make repeat purchases or require ongoing services.

Under a residual commission plan, the sales rep receives a commission based on a percentage of the recurring revenue generated from the customer's ongoing purchases or services. For example, in the insurance industry, a sales rep may receive a commission each time a policy is renewed.

When to use it?

A residual commission plan is best suited for industries where customers make repeat purchases or require ongoing services. Examples include insurance, telecommunications, and software industries. This plan is ideal for sales reps who excel at building long-term relationships with customers and enjoy the stability of a consistent income over time.

Pros: The advantages of a residual commission plan are that it incentivizes sales reps to build long-term relationships with customers and provides a consistent source of income over time. It also provides an ongoing motivation for sales reps to maintain the quality of the products or services they sell, ensuring customer satisfaction and loyalty.

Cons: Sales reps may become complacent once they have built up a base of recurring commissions, neglecting to seek out new customers or products. The commission structure may also be difficult to calculate and manage, particularly in industries with complex products or services.

Multiplier Commission Plan

A multiplier commission plan is a type of compensation model where sales reps receive higher commission rates as they achieve higher sales volumes/number of sales or exceed certain sales goals. The commission rate is multiplied by a predetermined factor, which increases as the sales representative reaches higher sales levels.

Under a multiplier commission plan, the commission rate increases in proportion to the sales rep’s performance. For example, a sales representative may receive a commission rate of 1% for sales up to $10,000, but this rate increases to 2% for sales between $10,000 and $20,000, and 3% for sales above $20,000.

When to use it?

A multiplier commission plan is best suited for industries where there is a high volume of sales, and the sales process is relatively short. Examples include retail, telecommunications, and software industries. This plan is ideal for sales reps who are highly motivated by financial incentives and enjoy a competitive sales environment.

Pros: The advantages of a multiplier commission plan are that it provides an incentive for sales reps to achieve higher sales levels and rewards them for exceeding their sales goals. It also encourages sales reps to close deals of higher-value sales and to develop their sales skills to increase their performance.

Cons: It may create a sense of competition among sales team members, which can lead to conflicts or tension in the workplace. It may also create a disincentive for sales reps to pursue smaller sales or customers who are less likely to generate high sales volumes.

How to Structure a Sales Commission Plan?

Step 1: Determine the Best Sales Commission Structures for Your Team

All of the above models suggest that there is no right model that works for every business. As a sales leader, you need to adopt what works best for you based on your business.

One of the best ways to go about sales commissions is to keep it standard and simple and then expand and experiment with different models only when it is not working for you. There are a few important factors that you can use to experiment.

Step 2: Evaluate the Stage Your Company Is In

If you are a growth stage company, you might want to go aggressive on the sales commissions structure to close as many businesses as possible. In the case of a cash-strapped company or a startup low on funds, you might look into a conservative approach with a lot of incentive pay compared to fixed pay.

Step 3: Evaluate the Industry of Your Company

If you are in a traditional industry where there is already a common way of sales commission structure that your reps are going to be well-versed with, complicating those with new models is not going to help you with hiring new hires.

In a saturated market, you can use aggressive commission structures as a way to attract new reps.

Step 4: Study Past Performance/KPIs of Your Sales Team

Any new commission plan will take 1 year to fully show results. So, if you want to evaluate comp plans, you should always look at 2 to 3 quarters for specific hypotheses to validate. Changing and adding new variables every year is a must if you want to remain competitive with the market.

Step 5: Check Alignment of Company’s Budget and Sales Goal

Sometimes, your finance team may not be able to afford the commission plan that you might have envisioned. Always keep your leadership and finance team aligned with regards to what the company can afford to spend for a particular sales goal. Promising something in advance without ensuring alignment is a sure shot recipe for disaster.

Step 6: Check if Your Plan Accounts for High and Low Performers

Certain companies go really hard on commissions for the top performers while they penalize the low performers a lot. Sure, this sounds sensible but if every team decides to not pay the low performers, then you are going to have serious employee trust issues.

Some reps might take a few quarters before they are fully ready. Always be considerate on low performers and ensure there is a fair plan available for them if they want to improve.

Sure, the sales commissions structure is in no way one-size-fits-all but you can always look for general thumb rules for guidance and understanding of your case.

Average Sales Commission Rates by Industry

A Sales rep’s commission rate can vary widely depending on the industry, the type of product or service being sold, and the specific company's sales compensation plan. That being said, here are some general guidelines on average sales commission rates by industry:

- Real Estate: In the real estate industry, commission rates typically range from 5% to 6% of the sale price of a property. This commission is usually split between the buyer's agent and the seller's agent.

- Insurance: Insurance agents typically earn commissions ranging from 5% to 10% of the premium paid by the policyholder.

- Retail: In retail sales, commission rates vary widely but typically range from 1% to 15% of the sale price of the product.

- SaaS / Technology: Salespeople in the technology industry can earn commissions ranging from 5% to 10% of the total sale, depending on the product or service being sold.

- Automotive: In the automotive industry, salespeople often earn a flat rate commission per vehicle sold, which can go upto 25%, depending on the dealership and the type of vehicle.

Here’s an article containing average sales commission rates benchmarks for a lot more industries across the spectrum.

What is a Sales Commission Agreement?

A sales commission agreement is a legal contract between a company and a salesperson or team that outlines the terms and conditions of their relationship. It establishes the commission rate or percentage that the salesperson or team will earn on the sales they generate, as well as any conditions or requirements that must be met in order to receive commissions.'

A sales commission agreement typically includes several components:

- Parties involved: The agreement should identify the parties involved, typically the company and the sales representative.

- Commission structure: The commission structure should clearly outline the percentage or amount of commission the sales representative will receive for each sale made, and under what circumstances the commission will be paid.

- Performance criteria: The agreement should specify the performance criteria that the sales representative must meet to be eligible for commission, such as achieving sales quotas or meeting other sales targets.

- Payment terms: The agreement should outline the payment terms for commission, including the frequency of payments, the method of payment, and any other relevant payment details.

- Termination clause: The agreement should include a termination clause, which outlines the conditions under which the agreement can be terminated by either party.

- Confidentiality and non-compete clauses: The agreement may also include confidentiality and non-compete clauses, which outline the responsibilities of the sales representative to protect the company's confidential information and to refrain from engaging in competitive activities.

- Signatures: The agreement should be signed by both parties to indicate their agreement to the terms and conditions outlined in the agreement.

How a Sales Commission Software fits into this equation

A sales commission software can provide a range of benefits for businesses that implement a commission structure. Some ways that a sales commission software can help with commission structures include:

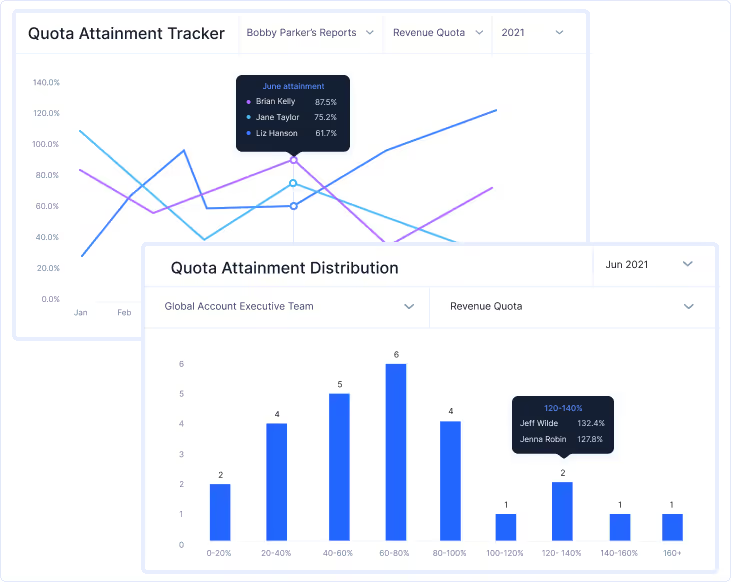

- Automated commission calculations: A commission software can automatically calculate commissions based on pre-defined commission structures and rules. This saves time and eliminates errors that can occur with manual calculations.

- Customized commission structures: Commission software can provide the flexibility to design custom commission structures that align with specific business goals and objectives.

- Real-time commission tracking: A sales commission software can provide real-time tracking of commissions, allowing sales reps to see their progress towards their targets and adjust their sales activities accordingly.

- Transparency and accountability: Commission software can provide transparency and accountability for commission calculations and payouts, reducing the potential for disputes or misunderstandings between sales reps and management.

- Integration with other systems: Commission software can integrate with other systems such as CRM, ERP, and accounting software, providing a comprehensive view of sales performance and commissions.

- Performance analytics: Commission software can provide detailed performance analytics, allowing businesses to identify top performers, track sales trends, and make data-driven decisions to optimize their sales processes.

Overall, a sales commission calculator can streamline commission management, improve accuracy, and provide valuable insights to help businesses achieve their sales goals and objectives.

Bottom Line

Sales commission structures are one of the best levers available to you to boost your revenue and ensure retention of your sales force. Please use it wisely with deliberate choices and clear goals. If you go careless on it, you will surely have a hard time scaling your revenue and maintaining your sales force's morale.

.avif)

.avif)

.avif)

.avif)