ASC 606 implementation in sales commission plans requires a structured approach to ensure compliance, accurate reporting, and alignment with business goals.

- Reassess your current commission structures and link incentives directly to company objectives.

- Learn from early adopters and expert insights to simplify the transition process.

- Categorize commission costs properly for audit-ready financial statements.

- Don’t stress—following expert-backed steps makes ASC 606 adoption manageable and effective.

We’ve covered a lot of details in our previous parts of the ASC 606 series, including SaaS revenue recognition with ASC 606 and its impact on SaaS sales commissions. As early adopters of ASC 606 say, it takes significant time and expertise to fully transition into the new revenue recognition standard. So if you’re still hustling to get your sales commission plans aligned with ASC 606 (IFRS 15), don’t stress yourself out.

As you become equipped with the knowledge and learnings from experts who are ahead in the new commission expense recognition journey, you’re sure to find a simple yet effective way to adopt ASC 606 in your sales commission plans.

And that’s exactly what we have in store for you!

Based on our conversations with CPAs and finance leaders, in part three of our ASC 606 series, we’ve summarized the important steps involved in implementing ASC 606 to ensure your sales commission plans are audit-ready.

Let’s go through them one by one. Shall we?

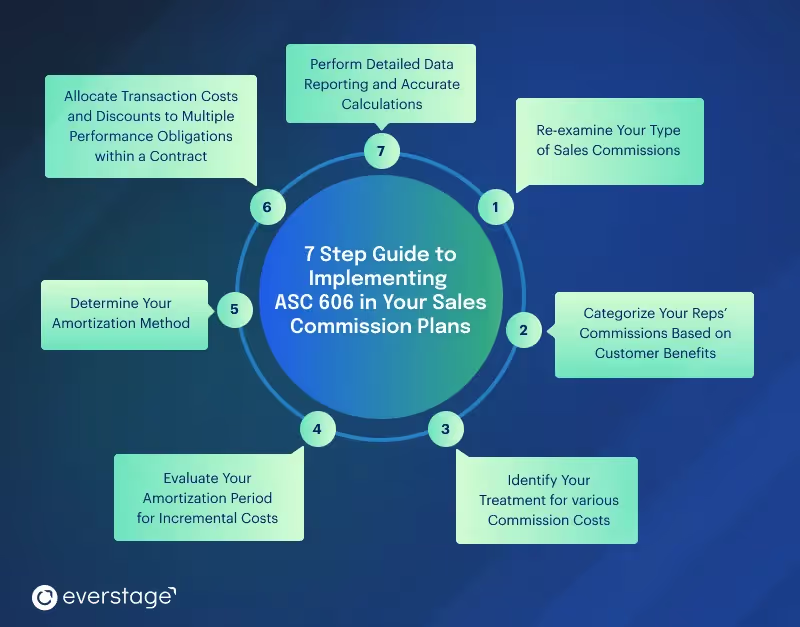

7 Step Guide to Implementing ASC 606 in Your Sales Commission Plans

1. Re-examine Your Type of Sales Commissions

To begin with, collect your historical commission data to understand the types of commissions that you currently offer to your sales reps and how their payments are being calculated. Also, try to identify the purpose of every incentive and map them against your business goals.

With this data, you’d be able to grasp the existing state of commissions in your organization. You could use this to analyze all the components of your variable compensation plan and ensure that your top management and sales teams are aligned with it.

It is critical to have a bird’s eye view of your variable compensation data and your existing types of commission plans to produce financial reports according to the ASC 606 compliance.

2. Categorize Your Reps’ Commissions Based on Customer Benefits

You could have multiple commission components to drive your reps towards a specific sales goal or behaviour. But, some of them might also be linked to the benefit/service provided to your customers. So, the commissionable component may have a different time to value in your customers’ perspective.

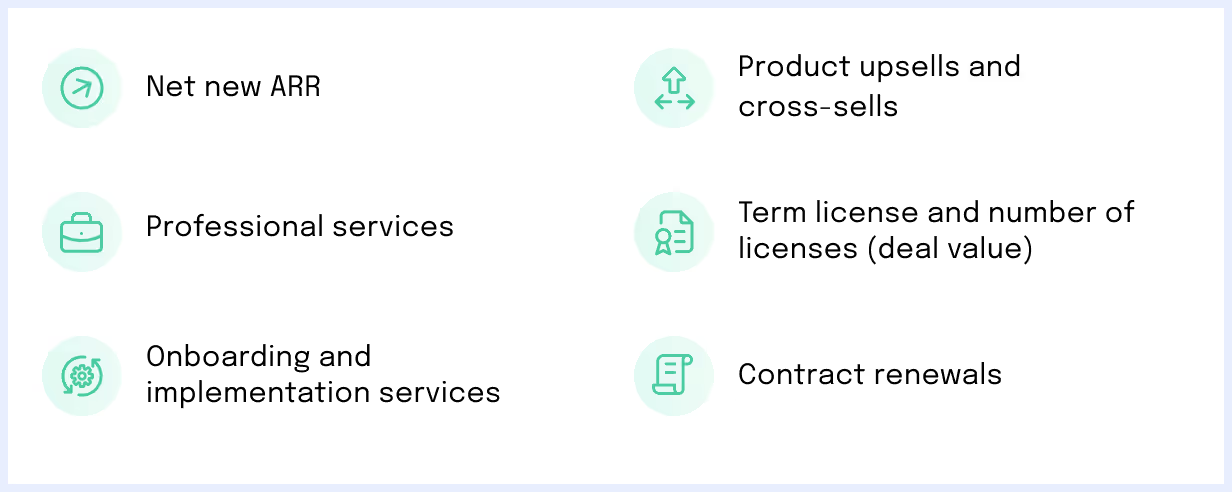

Below are some of the sales commission costs that associate with customer benefits,

Therefore, check your historical data and classify your commission costs according to their linkage with the services included in the initial contract. By this, you can pick out the cases where the contract costs need to be capitalized.

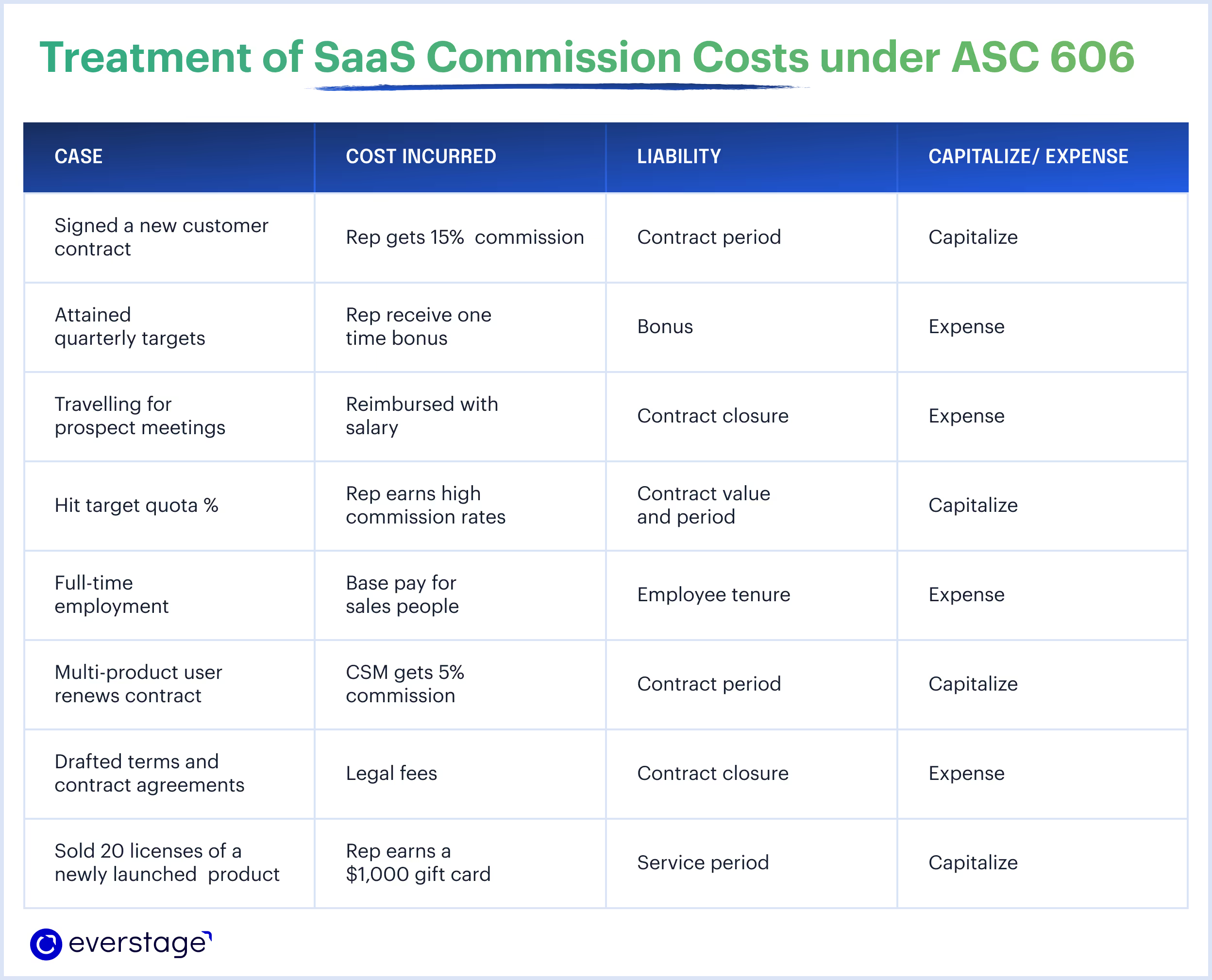

3. Identify Your Treatment for Various Commission Costs

FFASB‘s (Financial Accounting Standards Board) ASC 340-40 defines incremental costs as costs that an entity incurs to obtain a contract with a customer (for example, a sales commission).

So, based on this standard, you’d have to identify the commission costs that can be accounted for when incurred and which ones need to be capitalized. If the commission is capitalizable then you likely should capitalize at the point of accrual. To better understand the treatment of commission costs for specific sales use cases, refer to the table below.

4. Evaluate Your Amortization Period for Incremental Costs

To decide on the amortization period for your incremental costs, you must evaluate the long-term benefits of the commission being paid, and identify the inputs that provide the basis of that benefit. Then, for each input, you must decide the typical amortization period based on the contract term and estimated customer lifetime (i.e. how long do you expect to do business with a customer above and beyond the contract term.)

In the SaaS model, some inputs are obvious, like the initial contract term and expected renewals that extend the customer lifetime. However, a less obvious input to calculate the amortization period would be the technology life.

For example, if your customers purchased your product three years ago, it may not be similar to what you’re offering today. Your product might have matured or outdated over the years. Either way, the commission paid out on the initial contract is no longer relevant, however, the amortization period would be limited to about three years. And due to this irrelevance, your input for estimating the amortization period could be affected.

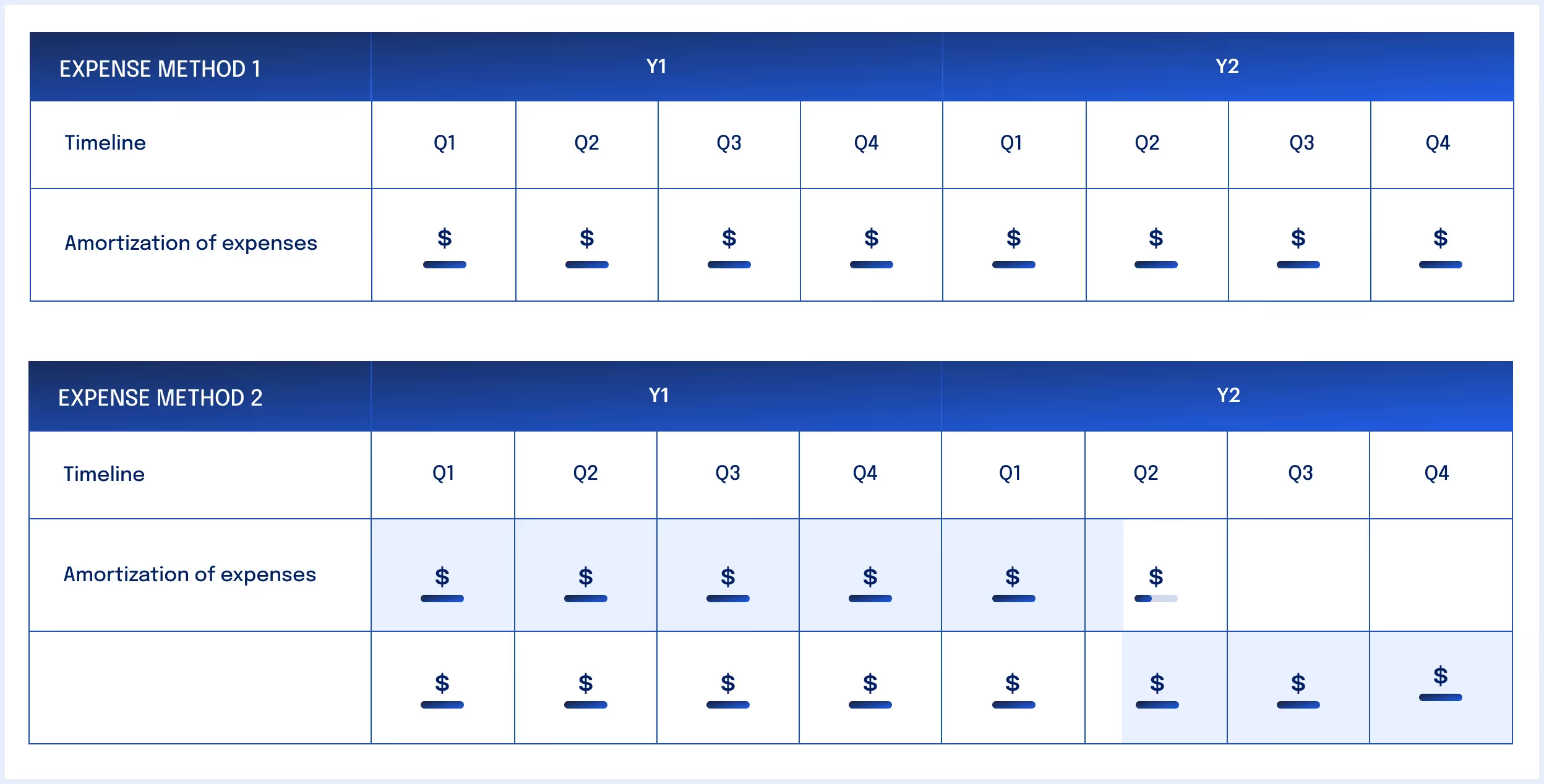

5. Determine Your Amortization Method

You don’t necessarily have to amortize expenses evenly (i.e) having an amortization period of 24 months, so you could expense 1/24th each month.

You can also choose to expense 2/3 the first year and 1/3 the second. But, ensure that you have a rationale behind making that choice, one that justifies the case for your amortization methodology.

Portfolio expensing is another way to do it. You can account for multiple contracts as a portfolio if certain criteria are met as per ASC 606. In this method, you could identify customer segments and amortize them over the estimated lifetime of that segment. You can also group commissions by product type, region, or go-to-market team, and assign an amortization life for each group. However, to follow this approach, you require a relatively high sales volume. If you only have a few big deals a quarter, it might not work as there’s too much variability in the contracts and the delivery periods.

6. Allocate Transaction Price and Discounts to Multiple Performance Obligations Within a Contract

On allocating transaction price: When your customer contract contains more than one performance obligation, the ASC 606 (IFRS 15) model states that you should allocate the transaction price determined to the performance obligations on the basis of the relative stand-alone selling price (i.e) the price at which you would sell a product or service separately to your customers at contract inception.

If this price is not directly available, you could estimate it by using any of these methods: adjusted market assessment approach, expected cost plus margin approach, or residual approach.

On allocating discounts: Additionally, ASC 606 specifies that when your customer receives a discount for purchasing a bundle of products or services, you must allocate the discount equally to all performance obligations in the contract.

To get a detailed view of the allocation of transaction cost, you can refer to the IFRS 15 illustrative example (IE) 33 on the allocation methodology and IE 169-172 on allocating a discount to one or more performance obligations.

On allocation method: If you’re in a SaaS business, a specific allocation approach might work out well. If you’re able to objectively determine that a contract cost asset is specific to one or more distinctive services of your customer contract, and not all, then it may be reasonable to allocate the contract cost asset entirely to that service(s). Based on the subtopic ASC 340-40 these costs are recognized as assets (costs to fulfill a contract) as they relate primarily to activities to fulfill the contract but do not transfer product or services to the customer.

An example for this would be paying a particular commission amount for selling a product that is varied from the commission amount for performing professional services.

7. Perform Detailed Data Reporting and Accurate Calculations

Before ASC 606, in most companies, sales commission calculations are performed with aggregated sales data that is based on the company’s ARR for the month.

But with ASC 606, companies may now need to disaggregate their data to show multiple products with differing revenue patterns such as up-front fees and post-contract services. This requires slicing of commissions calculations to the contract or product level, or a reasonable estimation method to disaggregate the commission data. In this way, you could use the data either for financial statements or for ongoing analysis in order to stay ASC 606 compliant.

You must have the data at your fingertips to perform math on sales basis, cash, accrual, deferred revenue, and all other accounting methods, which are chosen on a case-by-case basis.

P.S.- You’d have to successfully pass through all the 7 steps for every single customer contract that you’re dealing with in your business to be ASC 606 compliant.

ASC 606 Implementation in a Nutshell

We can’t agree more to the early-adopters saying, “It requires extensive time and expertise to pull this off”. And implementation of ASC 606 in Excel is sure to be a nightmare for finance teams (just picturing the volume of data could drive you crazy).

It could also be extremely exhausting to source and cross-verify data from multiple applications manually especially when you don’t have a clear view of your historical data, your calculations could be prone to errors.

It’s high time to stay ASC 606 compliant but also in an easy and stress-free manner. Don’t you think? And, the best way to save you and your teams from this havoc is to automate your sales commission calculations and reporting with a ASC 606 complaint platform like Everstage.

Everstage provides you with all the granular data needed to meet new revenue recognition standards like,

- Historical commission data

- Customizable reports and dashboards

- LTD Cost Waterfall

- Deferred costs

- Amortization period and amounts

- Detailed period rolls

- Dynamic true-up entries